How will the new tax law affect me?

- MCleveland

- Jan 3, 2019

- 2 min read

So I've received several texts, DM's, FB messages asking about

how the new tax laws will affect my clients so I decided to summarize here and share with everyone!

What changed?

So many things! Ten of the biggest changes to the tax laws are summarized below. This is NOT an all inclusive list and know that each individual situation will vary.

1) lower tax rates. The new brackets will be: 10%, 12%, 22%, 24%, 32%, 35% and 37% versus the previous 10%, 15%, 25%, 28%, 33%, 35% and 39.6%

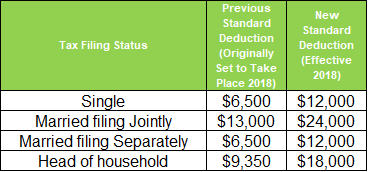

2) increased standard deduction (to reduce the number of taxpayers who itemize.) This helps to reduce your TAXABLE income. Check out the table below to see your new standard deduction.

3) suspending personal exemptions (this will especially impact those with large families) Previously personal exemptions were ~$4000 per person on the return. With the increased standard deduction, this has been removed until 2025. 😒 For a taxpayer with a spouse and 4 children, that's a pretty significant change.

4) increasing the child tax credit - now up to $2000 per child (including a portion that is refundable which means you can get money back even if you do not owe taxes)

5) addition of a $500 tax credit for dependents that are NOT children

6) limiting deductions on mortgage interest (on up to $750,000 now down from $1M)

7) Affordable Care Act - penalty for not having insurance reduced to $0. (This goes for tax year 2019, you may still be assessed a penalty if you did not have insurance in 2018.)

8) State & Local taxes limited to a $10,000 deduction for those that itemize.

9) Elimination of several deductions - moving expenses (unless you're military), unreimbursed job expenses, tax preparation fees, miscellaneous deductions subject to 2% rule.

10) Increased charitable contribution guidelines. Feeling generous? You can deduct qualified charitable contributions up to 60% of your adjusted gross income.

Will I owe or get a refund?

This is the number one question I receive and the answer is it depends. There are so many factors in each person's tax return. Your income, your dependents (if any), your exemptions claimed throughout the year, your total federal withholdings, eligibility for certain credits/deductions, etc. I really can not know until I look at your full tax situation. The great thing is that I offer FREE consultations and can tell you what you will get back or owe before I file your return.

Get started by clicking the link here to fill out the client data sheet so submit your information! I look forward to working with you and helping you get this sorted out!

Until next time,

Monique

.png)

Comments